Accounting is one of those things every business has to get right. But let’s be honest - it’s not always easy. Managing invoices, keeping track of payments, staying on top of taxes, and making sure your financial reports are accurate can feel overwhelming. And when you’re dealing with multiple systems that don’t talk to each other, it only makes things worse.

The good news? It doesn’t have to be this complicated.

Odoo Accounting simplifies financial management by bringing everything into one place. It’s built for businesses that want to spend less time on manual tasks and more time making smart financial decisions. Let’s take a look at some of the biggest accounting headaches - and how Odoo solves them.

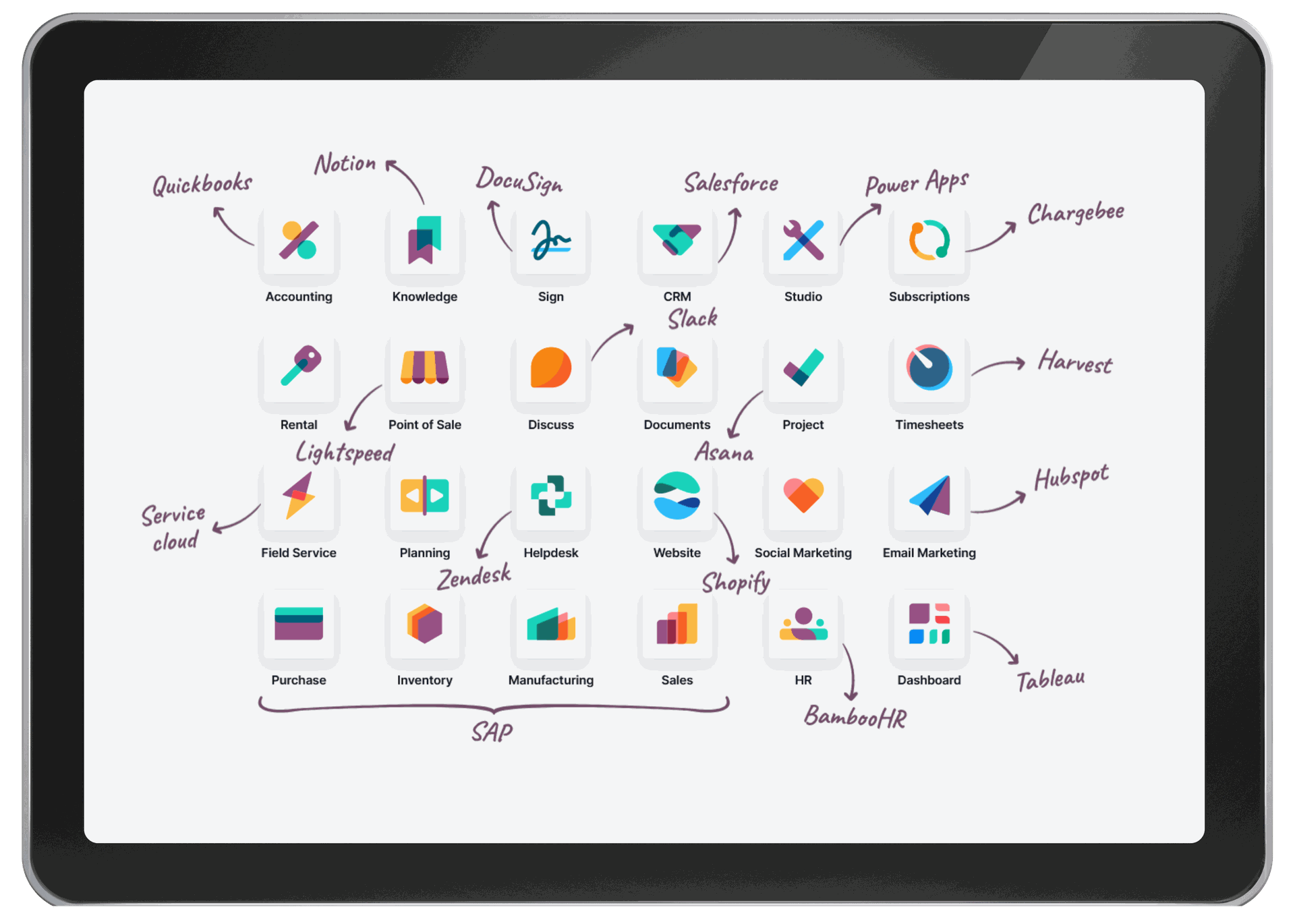

1. Too many systems, not enough clarity

The Problem:

Many businesses use different tools for invoicing, expenses, taxes, and payroll. The result? Data gets scattered, mistakes happen, and closing the books takes longer than it should.

How Odoo helps:

Odoo’s accounting seamlessly integrates with sales, purchases, inventory, and payroll, ensuring all your financial operations work together in one platform. This eliminates the need for manual data entry, reduces human errors, and saves you time by removing the hassle of switching between multiple systems.

P.S. If you run payroll in the UK, you know how frustrating it can be to keep everything in sync with your accounting system. With Smart IT’s UK Payroll, payroll data flows straight into Odoo - no manual entry or mismatched records. Salaries, taxes, and deductions are calculated automatically, so you can pay your team on time and stay compliant without the hassle.

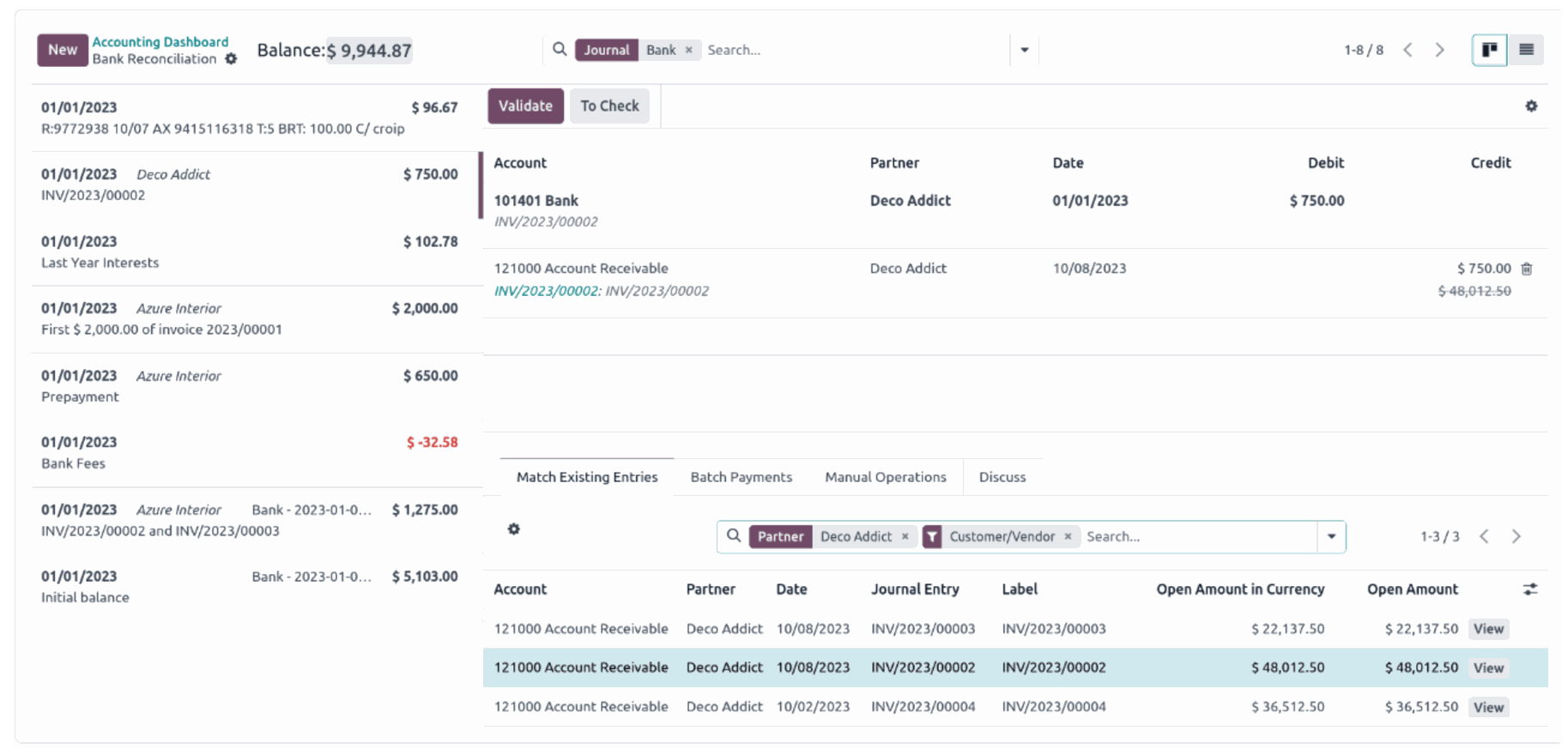

2. Bank reconciliation takes forever

The Problem:

Matching bank transactions to invoices is tedious and time-consuming. If your books don’t match your bank statements, finding the errors can take hours - or even days.

How Odoo helps:

Odoo connects directly to your bank and pulls in transactions automatically. It suggests matches for invoices and payments, so all you have to do is review and confirm. Instead of spending hours going through statements, you can reconcile accounts in just a few clicks.

Less manual work, fewer errors, and more time for what really matters.

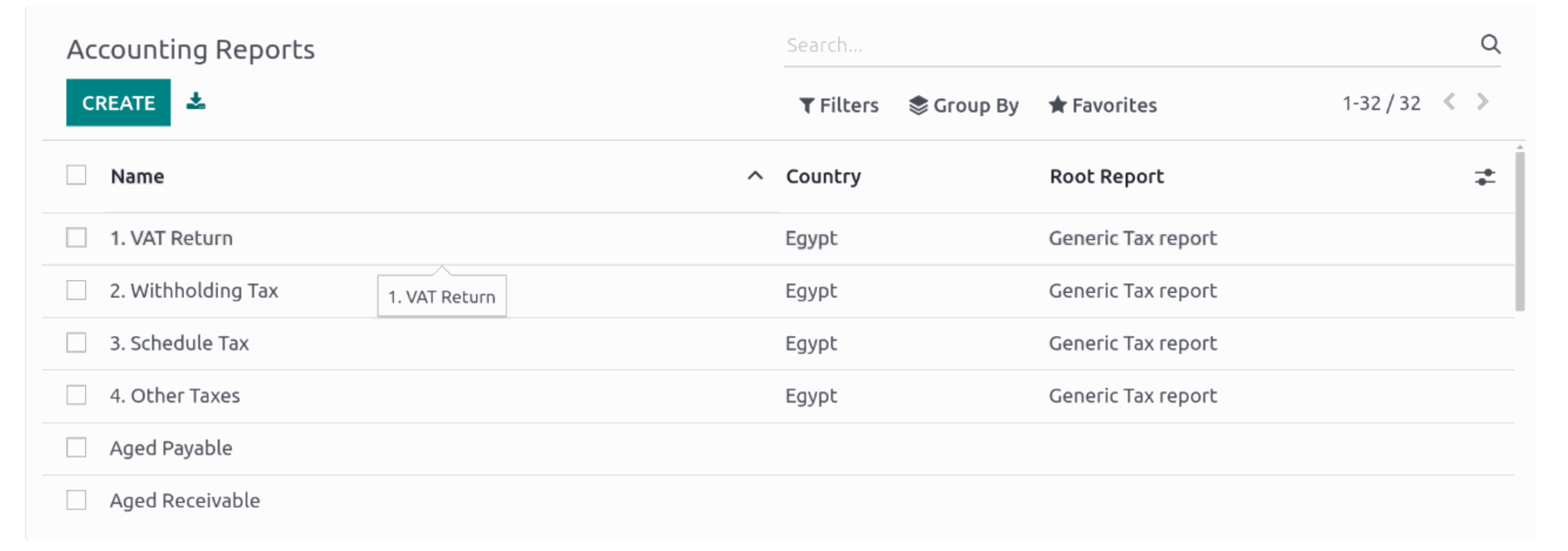

3. Financial reports are always late or inaccurate

The Problem:

When your financial reports are delayed or full of errors, making informed business decisions becomes a guessing game. You need real-time insights, not last month’s numbers.

How Odoo helps:

Odoo generates financial reports instantly - balance sheets, profit and loss statements, tax reports, and more. Since the system automatically pulls in data from across your business, your reports are always up to date and accurate.

No more waiting until the end of the month to know where your business stands.

P.S. Need even deeper financial insights? Smart IT’s EMAsphere integration takes Odoo’s reporting to the next level. With real-time dashboards, cash flow forecasting, and advanced analytics, you’ll have the clarity to make smarter financial decisions - without waiting for month-end reports.

4. Tax compliance is a nightmare

The Problem:

Different countries, different tax rates, different filing requirements - it’s enough to make anyone’s head spin. Manually calculating taxes increases the risk of errors, and mistakes can lead to penalties.

How Odoo helps:

Odoo automatically calculates taxes based on the latest regulations. Whether it’s VAT, GST, or other tax types, the system applies the correct rates and generates reports that make filing easier.

For businesses operating in multiple countries, Odoo handles multi-currency and multi-company tax reporting, so you stay compliant everywhere you do business.

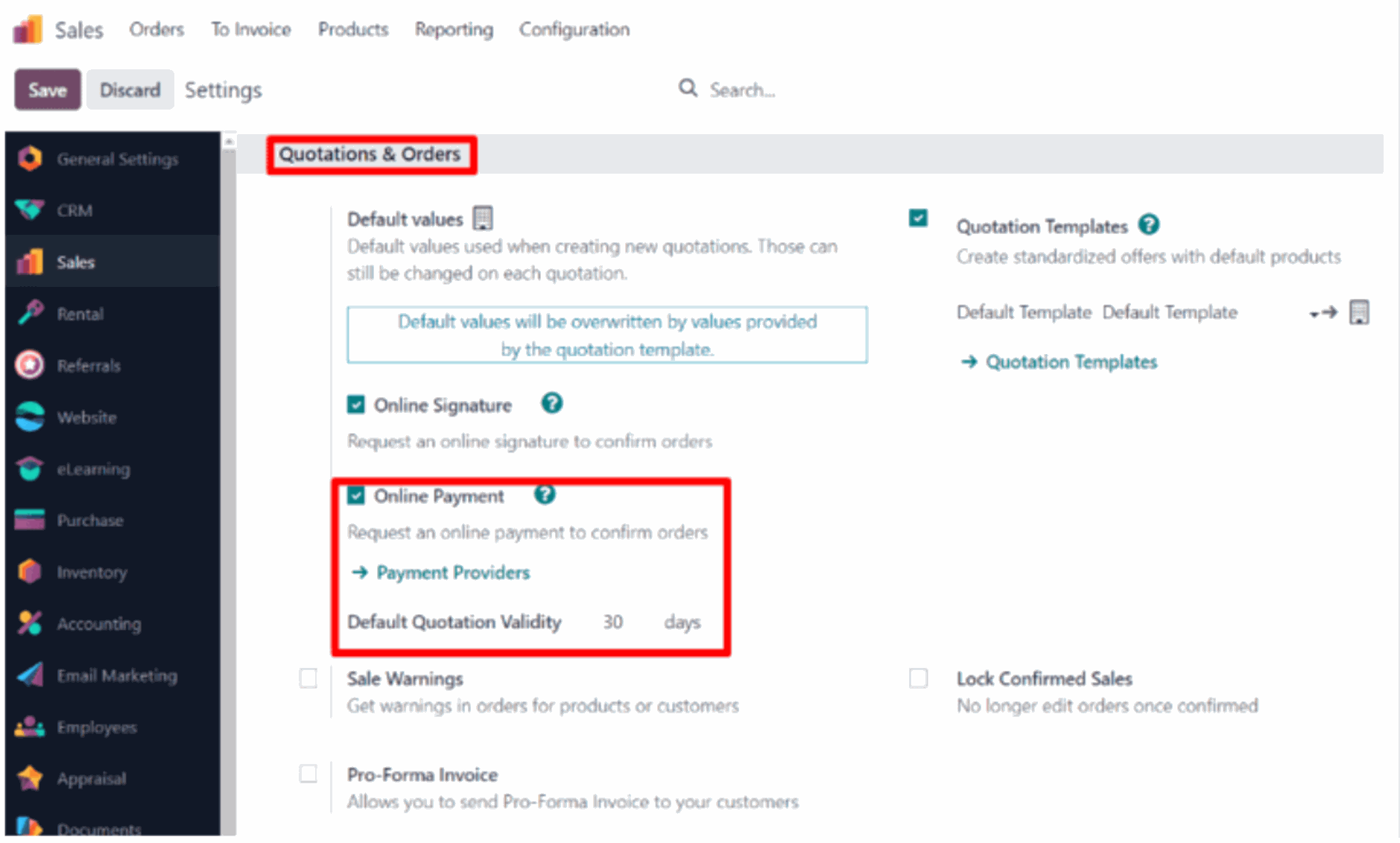

5. Late payments hurt cash flow

The Problem:

Chasing overdue invoices takes time, and when customers don’t pay on time, your cash flow suffers.

How Odoo helps:

Odoo automates invoice reminders, sending follow-ups to customers before payments are overdue. You can also offer online payment options, making it easier for customers to pay you faster.

With real-time cash flow tracking, you’ll always know where your money is coming from - and when to expect it.

6. Your business is growing, but your accounting system isn’t

The Problem:

What worked for a small business doesn’t always work as you scale. More customers, more transactions, and more locations mean more complexity. If your accounting software can’t keep up, it slows everything down.

How Odoo helps:

Odoo is built to grow with you. It supports multi-company accounting, so you can manage multiple business entities in one place. Plus, it’s cloud-based, so your team can access it from anywhere.

As your business expands, your accounting system won’t hold you back.

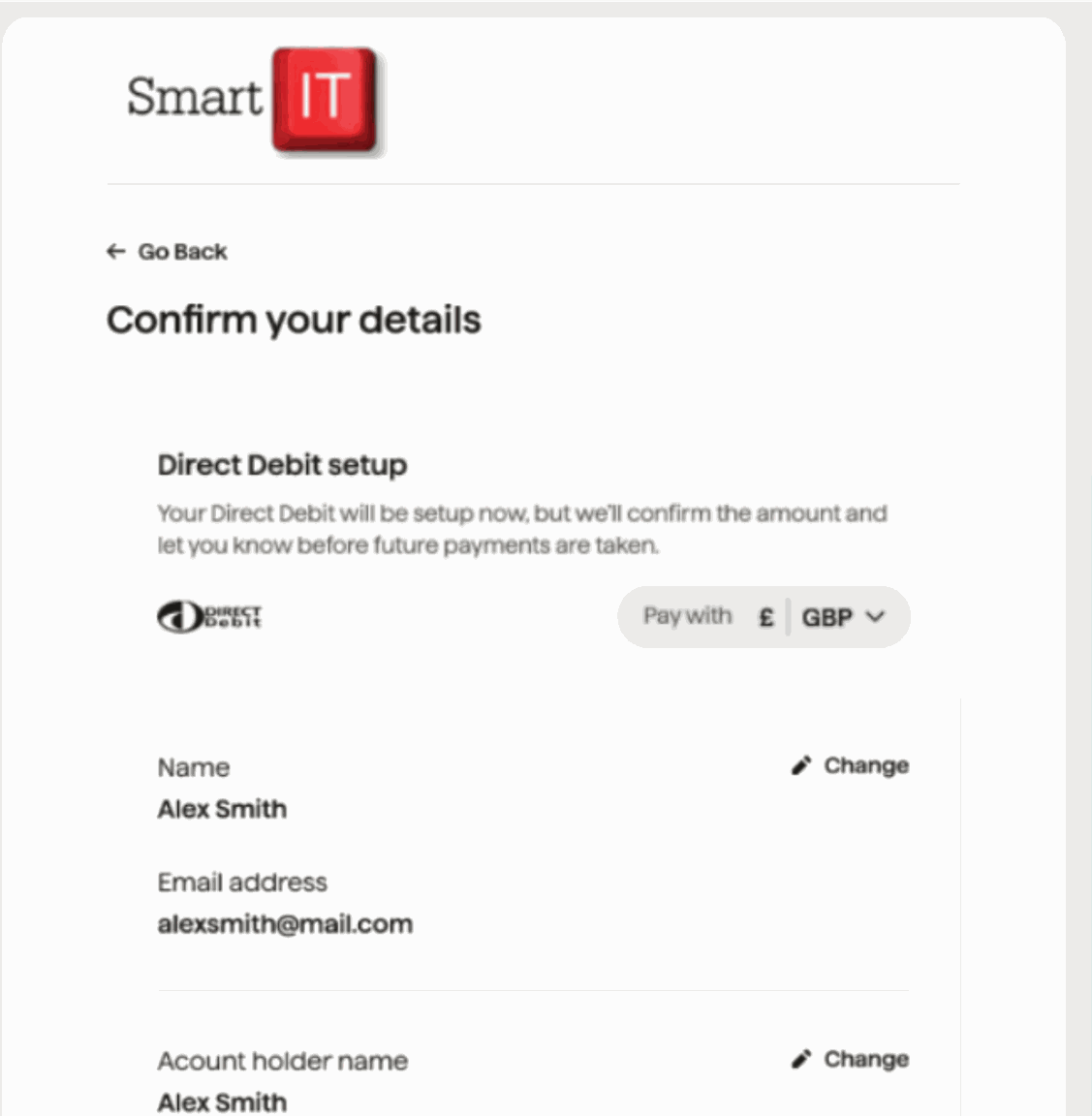

P.S. Want to get paid even faster? Smart IT’s Go Cardless integration automates direct debit payments in Odoo, so you can collect payments on time - without the hassle of chasing invoices. Set it up once, and let GoCardless handle the rest, ensuring a steady cash flow for your business.

Accounting shouldn’t be a constant headache. With Odoo, you get a modern, flexible system that simplifies financial management, reduces errors, and saves you time.

If your current accounting setup is slowing you down, maybe it’s time for a change.

Want to see how Odoo can work for your business?

Contact Smart IT today for a free consultation!

How Odoo solves common accounting challenges?